It has been a mixed start to the season for Arsenal, as promising away performances at champions Manchester City and a rejuvenated Liverpool have been balanced against a disappointing home defeat to Chelsea. However, there is an air of quiet optimism among the fans that Arsène Wenger’s new-look side will be able to mount a challenge once the new players have fully gelled. It certainly feels better than last year when the Gunners were on the wrong end of an 8-2 thrashing by Manchester United.

In fact, Arsenal recovered well after that disastrous start to finish in a creditable third position, securing qualification for the Champions League for a hugely impressive 15 seasons in a row. Even Wenger was moved to describe this feat as a “miracle”, citing the thrilling 5-2 victory over Spurs in the North London derby as the turning point. Nevertheless, it was a close run thing, as Arsenal only made sure of qualifying with a last day victory at West Brom.

The team’s inconsistent performances can be partly attributed to the significant amount of turnover in the playing squad, exacerbated by losing some of the club’s best performers each summer. Last year Cesc Fàbregas returned to his spiritual home at Barcelona, while Samir Nasri moved north to join Manchester City’s project. In the recent transfer window, it was the turn of leading scorer Robin Van Persie to head towards Manchester, though he opted for Old Trafford, while Alex Song joined the long list of Arsenal players transferred to Barcelona.

"Mertesacker - the power of Per-suasion"

Good arguments can be put forward that each of these sales may have made sense individually, e.g. RVP was in the last year of his contract, while the offer for Song was too good to refuse given his tactical indiscipline, but taken together they do give the impression that Arsenal have become a selling club, not overly bothered if their best players leave.

At least Arsenal appeared to have more of a plan this summer, recruiting international replacements before the departures, including the highly talented creative midfielder Santi Cazorla from Malaga, the experienced German forward Lukas Podolski from FC Köln and last season’s top scorer in Ligue 1Olivier Giroud from Montpellier. Furthermore, the return of Jack Wilshere and Abou Diaby after lengthy absences through injury enabled the club to wheel out the tried-and-tested “like a new signing” line.

However, many fans remain baffled that a club of Arsenal’s immense financial resources did not aim higher in the transfer market, such as buying a striker of the calibre of Napoli’s Edinson Cavani or Atlético Madrid’s Radamel Falcao. Of course, either of these would have broken Arsenal’s transfer record by some distance, but the money is clearly available to fund a purchase of this magnitude.

"Cazorla - Spanish eyes"

To the outside world, it appears that Arsenal have paid rather more attention to strengthening their balance sheet, as opposed to the squad, an impression that was reinforced by last week’s announcement of a hefty profit for the 2011/12 season, described by Peter Hill-Wood as “another healthy set of full year results.”

As is the chairman’s style, that was a beautifully understated description of a thumping great profit before tax of £36.6 million, which was up from £14.8 million the previous year. This was split between £34.1 million from the football business (up from £2.2 million in 2010/11) and £2.5 million from property development (down from £12.6 million).

The massive £32 million increase in football profit was mainly due to profit on player sales rising £59 million to an enormous £65 million, largely from Fàbregas and Nasri, though recurring revenue also rose £10 million to £235 million with more than half of the growth coming from commercial operations.

However, this was offset by substantial increases in staff costs of £40 million: wages climbed 15% (£19 million) from £124 million to £143 million; player amortisation surged 70% (£15 million) to £37 million after last summer’s acquisitions; and a £6 million impairment charge was booked to reduce the value of players “deemed to be excluded from the Arsenal squad.”

Net interest charges continued to fall, down to £13.5 million from £14.2 million (£18.2 million in 2009/10).

As anticipated, there was a further slow-down in the property business with turnover falling from £30.3 million to £7.7 million, as the Highbury Square development is now almost entirely sold.

Chief executive Ivan Gazidis was at pains to emphasise the club’s self-sustaining model, claiming that the club “can and will forge its own path to success”, though he must be concerned about the continuing decline in operating profits, which have fallen from a £31 million peak in 2008/09 for the football business. In fact, excluding property development, the club actually reported an operating loss of £18 million last season, compared to the previous year’s £9 million operating profit. This £28 million turnaround was due to operating expenses (£38 million) rising much faster than revenue (£10 million).

Nevertheless, the bottom line is that Arsenal once again made another sizeable profit, even if it was largely on the back of player sales. There is no doubt that the club’s record off the pitch has been superb, especially in the unforgiving world of football, where large losses are frequently the order of the day. In fact, the last time that Arsenal reported a loss was a decade ago in 2002, amply demonstrating its self-financing ethos. The last five years have been particularly impressive, at least financially, with Arsenal accumulating staggering profits of £190 million, an average of £38 million a year.

Arsenal have consistently been one of the most profitable clubs in the world, though they are not quite the only leading club to make money. Both the Spanish giants have recently reported large profits for 2011/12: Barcelona £41 million (€49 million) and Real Madrid £27 million (€32 million). In addition, Bayern Munich have been profitable for 19 consecutive years. Manchester United slipped to a £5 million loss (before tax) last season, dragged down by £50 million of interest charges, though they made a £30 million profit the previous year.

At the other end of the spectrum, clubs operating with a benefactor model reported enormous losses. Manchester City’s £197 million loss in 2010/11 was the largest ever recorded in England, while Juventus, Inter, Chelsea and Milan all registered losses of around £70 million. As Gazidis put it, “we see clubs struggling to keep pace with the financial demands of the modern game.”

That said, the arrival of UEFA’s Financial Fair Play (FFP) regulations, not to mention the economic difficulties of many of the clubs’ owners, has produced a clear change in behaviour. Milan and Inter have been selling their experienced, more expensive players, while City were relatively restrained in the transfer market (by their own exalted standards) this summer. Even Chelsea’s spending has been on younger players with a future resale value.

So far, so good, but Arsenal’s profits have been very reliant on player sales and (to a lesser extent) property development. In 2011/12, if we exclude the £2.5 million profit from property development and the £65.5 million profit from player sales, the football club would actually have made a sizeable loss of £31.3 million.

No other leading club has been so dependent on player sales as part of its business model. In fact, over the last six years, selling the club’s stars has been responsible for £178 million (or over 90%) of the £195 million total profit. That’s great business, but it makes it very difficult to build a winning team, as Arsenal seem to be perpetually two pieces short of the complete jigsaw.

There’s little sign of this slowing down either, as the sales of Van Persie and Song were made after the 31 May accounting close, so will be included in next year’s accounts, contributing another £37 million of profit.

These “once-off” sales are all well and good, but they have been disguising Arsenal’s increasing operational inefficiency. This can be seen by the decline in cash profits, known as EBITDA (Earnings Before Interest, Taxation, Depreciation and Amortisation), which has virtually halved from a peak of £66 million in 2008/09 to £35 million last season. That’s still pretty good for a football club, but, to place it into context, it is less than 40% of the £92 million generated by Manchester United, who also forecast growth to £107-110 million this season.

This may be a tiresome accounting term, but it is important, as it represents the cash available for a club to spend – unless it sells players or increases debt. Assuming no change in overall strategy, this means that Arsenal will continue to sell players unless/until they grow revenue or cut their wage bill.

As Gazidis explained, “The reason we talk about the financial results at all is that it provides the platform for us to be successful on the field.” Given this truism, let’s look at some of the challenges facing Arsenal.

1. How will the club grow revenue?

Looking at the club’s revenue of £235 million, which is the fifth highest in Europe, it is difficult to imagine that this could be an issue, especially as it is only surpassed by Manchester United in England (£331 million in 2010/11, £320 million in 2011/12), while it is way ahead of clubs like Liverpool £184 million, Tottenham £164 million and Manchester City £153 million.

However, there are three problems here: (a) the gap to the top four clubs is vast; (b) Arsenal’s revenue has hardly grown at all in the last few years; (c) other clubs have continued to grow their revenue.

Real Madrid and Barcelona generate around £200 million more revenue than Arsenal. Even though this shortfall would come down if the current exchange rate of 1.25 Euros to the Pound were used instead of the 1.11 prevailing when Deloitte produced their survey, the disparity would still be around £150 million, which makes it difficult to compete.

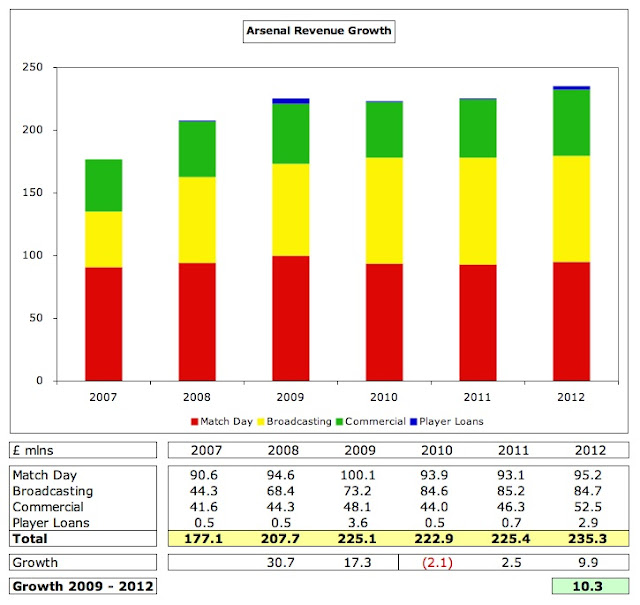

Although revenue rose £10 million last season to £235 million, this is effectively the only revenue growth since 2009, when revenue was £225 million. The largest increase in this three-year period came from broadcasting, which rose £11 million from £73 million to £85 million in 2012, as a result of centrally negotiated deals for the Premier League and UEFA (for the Champions League), so Arsenal’s board cannot take a great deal of credit for that.

Much was made of commercial revenue rising £5.6 million to £52.5 million, but this is only £4.4 million higher than the £48.1 million received in 2009. In other words, this crucial revenue stream has only grown by a miserable 9% in three years. Even though Gazidis stated in an interview with the club website that commercial partnerships were “well ahead of our five-year plan”, I would suggest that to date there has is not exactly been a scintillating return on investment in the expensive new commercial team.

"Giroud - handsome devil"

The most important revenue stream for Arsenal, match day income, has actually fallen from £100 million to £95 million, despite ticket prices being raised last season.

It is imperative that Arsenal manage to find ways to profitably grow their revenue, as Gazidis acknowledged during the results presentation, “Our activities to increase revenue are important. Increased revenues allow us to be more competitive and to keep pace with the ever present cost pressures in the game.” The club’s Chief Commercial Officer, Tom Fox, re-iterated this, when he described his role as “to build and grow the multiple revenue streams at the club in order to maximise the money available for the board and the manager to spend on the squad.”

Arsenal’s real revenue problem is that while they have struggled to increase their revenue, other leading clubs have continued to grow their business. In the three years since 2009, Real Madrid and Barcelona both grew revenue by around £90 million. Madrid have just announced record-breaking £411 million (€514 million) revenue for 2011/12, while Barcelona are not far behind with £381 million (€476 million).

For English clubs, United’s revenue fell back to £320 million in 2011/12 after their earlier Champions League exit, but still represented growth of £42 million since 2009, while the 2012/13 revenue outlook they provided to analysts was a mighty £350-360 million. The only leading club whose growth was anywhere near as low as Arsenal’s was Chelsea, but their 2011/12 figures will be much higher, due to the Champions League victory and new commercial deals.

Arsenal’s Achilles’ heel from a revenue perspective has been commercial income, which is extremely low for a club of Arsenal’s stature. Even after the 13% increase to £53 million in 2011/12, this still pales into insignificance compared to the likes of Bayern Munich £161 million, Real Madrid £156 million and Barcelona £141 million.

The story is no better in England, as Arsenal’s £53 million is less than half of Manchester United’s £118 million. While Arsenal have barely registered any commercial growth since 2009 (just £4 million), others have steamed ahead, including Manchester City (£41 million growth) and Liverpool (£17 million growth). The discrepancy will be even worse when those two clubs publish their latest accounts, as the 2010/11 figures do not include the increases for new sponsorship deals with Etihad and Warrior respectively.

Arsenal’s problems in this area can be highlighted by a comparison with Manchester United, who admittedly are the commercial benchmark for English clubs. Back in 2007, Arsenal’s commercial income of £42 million was just £14 million lower than United’s £56 million, but since then Arsenal’s revenue has only risen 26% to £53 million, while United’s has rocketed 110% to £118 million, leading to an annual difference of £65 million. Mind the gap, indeed.

Arsenal’s weakness in this area arises from the fact they had to tie themselves into long-term deals to provide security for the stadium financing, which arguably made sense at the time, but recent deals by other clubs have highlighted how much money Arsenal leave on the table every season.

The Emirates deal was worth £90 million, covering 15 years of stadium naming rights (£42 million) running until 2020/21 and 8 years of shirt sponsorship (£48 million) until 2013/14. Following step-ups the shirt sponsorship deal is worth £5.5 million a season, which compares very unfavourably to the amounts earned by the other leading clubs, who have all improved their deals in recent seasons, so Liverpool, Manchester United and (reportedly) Manchester City earn £20 million from Standard Chartered, Aon and Etihad respectively.

In fact, no fewer than eight Premier League clubs now have a more lucrative shirt sponsorship than Arsenal. As well as the usual suspects, Arsenal’s deal is behind Sunderland’s barely credible £20 million deal with Invest in Africa, Tottenham £12.5 million (Aurasma £10 million plus Investec £2.5 million), Newcastle £10 million (Virgin Money) and Aston Villa £8 million deal (Genting).

The news is no better with Arsenal’s kit supplier, where the club signed a 7-year deal with Nike until 2011, which was then extended by three years until 2013/14. This now delivers £8 million a season, compared to the £25 million deal recently announced by Liverpool with Warrior Sports and the £25.4 million paid to Manchester United by Nike.

Gazidis talks a good match, “we continue to be successful in attracting top brands to sign on as commercial partners”, but the reality is that Arsenal have been outpaced in this area. Yes, they have indeed signed some new sponsors, such as Carlsberg, Indesit, Betsson, Bharti Airtel and Malta Guinness, while other like Citroen and Thomas Cook renewed for a higher sum, but there has been little tangible revenue improvement. Furthermore, Manchester United continue to attract more secondary sponsors than Arsenal, including seven since 1 July 2012 alone.

Indeed, much of the commercial revenue growth was down to the overseas tour to Malaysia and China, which is something of a double-edged sword, as it may well have had a detrimental effect on the players’ pre-season preparation.

"Jenkinson - corporal punishment"

More positively, Arsenal will have a fantastic opportunity for what Gazidis calls “a significant uplift in revenue” when the main sponsorship deals are up for renewal at the end of the 2013/14 season. If they could match the £45 million currently received by United and Liverpool for main shirt sponsor and kit supplier, that would imply a £32 million increase in revenue.

Great stuff, but the trouble is that the bar is being continually raised in sponsorship deals, so United have recently announced a truly spectacular deal with Chevrolet. Not only will this rise to an astonishing £45 million ($70 million) in 2014/15, but the sponsor will even pay them £11 million in each of the previous two seasons – while Aon are still the sponsors. Not only that, but United have also persuaded DHL to pay £10 million a season to sponsor their training kit.

In other words, there is no guarantee that Arsenal’s new sponsorship deals will ride over the hill like the seventh cavalry to save them, especially if the brand is damaged by a failure to qualify for the Champions League (though that has not prevented Liverpool from securing superb deals). Gazidis has said that “in terms of the financial impact, it will be as significant a step forward as the stadium was in 2005”, but his commercial team will have to significantly up its game – or Tom Fox will be considered about as effective “in the box” as Franny Jeffers.

Match day income of £95 million is the fourth highest in Europe, only behind Real Madrid, Manchester United and Barcelona, but that makes the club very reliant on the revenue generated in the stadium – “more so than any other club”, as Gazidis stated. Wenger confirmed its importance, “We are very lucky because we have good support and the income of our gates is very high.” Indeed, the £3.3 million that Arsenal generate per match is more than twice the amounts earned by Tottenham and Liverpool.

However, this revenue stream seems to have reached saturation point, as Arsenal continue to register capacity crowds of 60,000 and their ticket prices are among the highest in the world. In fact, match day income was actually higher in 2008/09 at £100 million, largely due to the high number of home games played (or old-fashioned success on the pitch). Furthermore, revenue per match has also fallen from the peak of £3.5 million in 2009/10.

Indeed, after the deeply unpopular 6.5% ticket price rise in 2011/12, most prices were frozen for this season, though 7,000 Club Level members were asked to pay an additional 2%. The media made great play of the cheapest tickets for the match against Chelsea (an A category game) being an obscene £62, though they have been less voluble about the 28% reduction in prices for C category games from £35 to £25.50. In addition, Arsenal have introduced a number of pricing initiatives, e.g. discounting lower-tier tickets to £10 for the Capital One Cup game against Coventry City.

The other issue here is what would happen if Arsenal failed to qualify for the Champions League, even if the inferior Europa League was on offer, as the season ticket includes the first seven cup games from European competition and the FA Cup. The club would surely have to issue credits, potentially leading to a 10-20% reduction in revenue.

The majority of Arsenal’s television revenue comes from the Premier League central distribution with the club receiving £56 million in 2011/12, unchanged from the previous season. Each club gets an equal share of 50% of the domestic rights (£13.8 million) and 100% of the overseas rights (£18.8 million) with the only differences down to merit payments (25% of domestic rights) and facility fees (25% of domestic rights), based on how many times each club is broadcast live. This methodology is very equitable with Arsenal only receiving £4.4 million less than champions Manchester City.

However, the signing of the £3 billion Premier League deal for domestic rights for the 2014-16 three-year cycle, representing an increase of 64%, will “provide clubs with a significant boost to their revenue” per Gazidis. If we assume (conservatively) that overseas rights rise by 40%, that would increase Arsenal’s share by around £30 million (using the same allocation system).

Of course, other English clubs’ revenue would also rise, though lower placed clubs would not receive as much in absolute terms, but this would certainly help Arsenal’s ability to compete with overseas clubs, especially Madrid and Barcelona, who benefit from massive individual deals.

The other major element included in TV revenue is the distribution from the Champions League, which was worth around £24 million (€28 million) to Arsenal in 2011/12. The amount earned depends on a number of factors: (a) performance – a club receives more prize money the further it progresses; (b) the TV (market) pool allocation – half depends on the progress in the competition, half depends on the finishing position in the previous season’s Premier League; (c) exchange rates – the 2011/12 figure was adversely affected by the Euro’s weakness.

In this way, Chelsea earned more than twice as much last season as Arsenal with €60 million after their triumph in Munich. Interestingly, Manchester United (€35 million) also earned more than Arsenal, despite being eliminated at the group stage, as their share of the market pool was higher after winning the previous season’s Premier League, while Arsenal finished fourth. Potentially, Arsenal could increase their revenue by €30 million if they managed to emulate Chelsea’s success, but, by the same token, they could lose €30 million if they missed out on qualification to Europe’s flagship tournament.

However large the differences are between the English clubs that qualify for the Champions League, it is still much better than the Europa League, where the highest amount earned by an English representative was the €3.5 million that went to Stoke City. Financially, the Champions league is the only game in town, especially now that the prize money for the 2012 to 2015 three-year cycle has increased by 22%.

2. Are expenses out of control?

Last season saw the first operating loss in many years after expenses rose at a much faster rate than revenue. In particular, the wage bill shot up 15% from £124 million to £143 million, despite the sale of Fàbregas and Nasri, two of the highest earners. Part of the increase was presumably due to rushing in the likes of Per Mertesacker, André Santos and Park-Chu Young last summer without enough time for meaningful salary negotiations.

In addition, a once-off charge of £2.2 million was included to top-up the pension provision, while Arsenal’s lack of trophies and commercial growth did not prevent Gazidis’ package rising 24% to £2.15 million (salary £1.366 million, bonus £675,000, pension £100,000).

The explosive wage growth is nothing new. In fact, since 2009 wages have gone up £39 million (38%), while revenue has only grown by £10 million (5%), leading to a significant worsening in the wages to turnover ratio from 46% to 61%. This is by no means terrible (most Premier League teams have a ratio above 70%, while Manchester City notched up 114% in 2010/11), but is of concern, especially as Manchester United have managed to maintain their ratio around 50%. Though not the only reason, this helps to explain why so little has been spent in the transfer market.

The problem is that wages in football resemble a sporting arms race, as other clubs continue to set the agenda, notably Manchester City, who have increased their wage bill from £36 million to £174 million in just four years. Arsenal’s wage bill of £143 million is now the fourth highest in England, behind City, Chelsea £168 million (2011) and Manchester United £162 million (2012).

Arsenal’s performance in regularly finishing third or fourth in the Premier League means they have slightly outperformed expectations based on the wage bill, though Tottenham fans would note that they ran them very close last season with £30 million less wages.

"Wenger - train of thought"

One issue at Arsenal is the equitable wage structure, which means that the top salaries are not enough to attract the world’s best, while fringe players like Sébastien Squillaci and Marouane Chamakh are handsomely rewarded for sitting in the stands. Arsenal’s wage bill is sufficient to sign world-class players, but that would mean reducing the salaries of lesser lights. This has been tacitly admitted by Gazidis: “Can we compete at top salary levels? Yes we can, but we have an ethos at the club - the way Arsène expresses it is that it is not about individual players, it is what happens between them.”

The difficulty is in getting the unwanted players off the payroll at their high wages, hence loans for Nicklas Bendtner, Denilson and Park when the club would have preferred to sell them. However, there are signs that the club is now acting on this with numerous departures this summer and the hard line over contract discussions with Theo Walcott. This is a tricky balancing act for the board: if they extend contracts too early, they risk paying over the odds in wages; if they wait until the last minute, they risk losing the player for nothing on a Bosman.

The other expense impacted by investment in the squad, player amortisation, has also risen significantly from £22 million to £37 million. For those unfamiliar with this concept, amortisation is simply the annual cost of writing-down a player’s purchase price, e.g. Mikel Arteta was signed for £10 million on a 4-year contract with the transfer reflected in the accounts via amortisation, which is booked evenly over the life of his contract, so £2.5 million a year.

Many of the players that have been sold were fully amortised, so amortisation was reduced much by the departures, but it has increased following investment in new players. To give this some perspective, it’s still a lot less than Manchester City (£84 million), but significantly more than previous years.

3. Where has all the money gone?

After so many years of large profits, it is difficult for most supporters to understand where all the money has gone. Gazidis is adamant that it has been spent on football, “We generate revenue and we reinvest all of that revenue in football. We don't pay dividends, the money doesn't come out of the club. All of the money we make is made available to our manager and he has done an unbelievable job in managing that spend.”

That’s sort of true, but the reality is that very little has been spent on bringing in new players with net player registrations of just £4 million in the last six years. Instead, the vast majority has been gone on the new stadium, property and other infrastructure (e.g. enhancements to Club Level, “Arsenalisation” projects, new medical centre) with more planned for development at the Hale End youth academy.

Since 2007 Arsenal have generated a very healthy £376 million operating cash flow, but have spent £71 million on capital expenditure, £110 million on loan interest and £64 million on net debt repayments, while the cash balances have risen by £118 million. Astonishingly, only 1% (one per cent) of the available cash flow has been spent in the transfer market.

Although Arsenal have laid out a fair bit of cash on buying players in the last two seasons (nearly £90 million), this has been more than compensated by big money sales, so their net spend has still been negative. In fact, since they moved to the Emirates stadium, they have made £49 million in the transfer market, where they are the only leading English club to be a net seller.

Of course, Manchester City and Chelsea have been the big spenders in recent years, splashing out £444 million and £235 million respectively since 2006/07. Little wonder that Peter Hill-Wood complained, “At a certain level, we can’t compete.” That said, in the same period, Liverpool, Manchester United and Tottenham have also all spent considerably more than Arsenal.

Following the elimination of the property debt, the club has managed to reduce its gross debt to £253 million (down £5 million from last year), leaving just the long-term bonds that represent the “mortgage” on the Emirates Stadium (£225 million) and the debentures held by supporters (£27 million). Once cash balances of £154 million are deducted, net debt is now only £99 million, which is a significant reduction from the £318 million peak in 2008.

Despite the high interest charges, it is unlikely that Arsenal will pay off the outstanding debt early. The bonds mature between 2029 and 2031, but if the club were to repay them early, then they would have to pay off the present value of all the future cash flows, which is greater than the outstanding debt. In any case, the 2010 accounts clearly stated, “Further significant falls in debt are unlikely in the foreseeable future. The stadium finance bonds have a fixed repayment profile over the next 21 years and we currently expect to make repayments of debt in accordance with that profile.”

4. How much is available to spend?

This question is provoked by Arsenal’s incredibly high cash balances of £154 million, which are significantly higher than any of their competitors with Manchester United the closest with £71 million (down from £151 million in 2011). Of course, not all of this is available to spend for a couple of reasons: (a) the seasonal nature of cash flows during the year, e.g. the May balance will always be high following the influx of money from season ticket renewals, but this money is used to pay annual expenses, including wages; (b) as part of the bond agreements, Arsenal have to maintain a debt servicing reserve, which was £34 million in 2012.

Nevertheless, there is clearly still a large amount of cash available to spend, especially as the cash balance does not include £26 million to come from the Queensland Road property development (though this is only payable in instalments over the next two years) and more (£10 million?) from the two remaining “smaller projects” on Hornsey Road and Holloway Road. It also excludes any money from this summer’s transfer activity with the accounts giving a positive net impact of £11 million.

Although this is probably the figure most fans want to know, it is actually almost impossible to calculate what could be spent in the transfer market for many reasons. For example, most transfers are funded by stage payments, so all the money is not needed upfront. In addition, Arsenal could easily take on some additional debt, given the strength of the balance sheet. Nevertheless, I estimate that Arsenal could safely spend £50-60 million from cash resources.

"Diaby - king of pain"

The other point that people often raise when discussing the transfer fund is that it would also have to fund a new signing’s wages, so if the club bought a player for £25 million on a five-year contract at £100,000 a week, that would represent a commitment of £50 million. That is undoubtedly true, but it is a little disingenuous, as it ignores the fact that this would be at least partially offset by the departure of an existing player, not least because of the limitations imposed by the 25-man squad rule, as highlighted by Wenger himself.

5. Will FFP come to Arsenal’s rescue?

It is no secret that Arsenal hope that UEFA’s FFP regulations will reward their prudent approach, as these aim to force clubs to live within their means, thus restricting the ability of benefactor-funded clubs to spend big on players. Indeed, Gazidis stated that the advent of FFP meant that “football is moving powerfully in our direction”, while the results press release was actually entitled, “Results confirm Arsenal strongly placed to meet UEFA’s new financial rules.”

On top of that, there are discussions at the Premier League to introduce similar rules domestically. However, although there are some signs of clubs modifying their behaviour, Arsenal’s faith in the new system may not work out as planned.

First, there is much leeway in the FFP rules, e.g. clubs are allowed to absorb aggregate losses of €45 million (around £36 million), initially over two years for the first monitoring period in 2013/14 and then over three years, as long as they are willing to cover the deficit by making equity contributions. In addition, certain costs such as depreciation on fixed assets, stadium investment and youth development can be excluded from the break-even calculation.

Furthermore, there is a sliding scale of sanctions for offenders, so it is far from certain that clubs will be excluded from UEFA competitions. This is without considering the threat of a legal challenge from a leading club.

Second, it is evident that FFP will benefit those clubs that have the highest revenue, as they will be able to spend more on their squad, but, as we have seen, other clubs continue to power ahead, so Arsenal are likely to always have a shortfall against some clubs.

"I am Vito Mannone!"

With the new commercial deals in 2014 plus more money from better central TV deals for the Premier League and Champions League, Arsenal should surpass £300 million revenue in two years, but Real Madrid and Barcelona are already around £400 million, while Manchester United are projecting £350-360 million next year.

That said, Arsenal’s revenue will place them in the revenue elite (“the top five clubs in the world with separation from the rest”, said Gazidis), so they will be very handily placed to benefit from FFP, though it is unlikely to act as some kind of magic potion to solve all of their financial issues.

In many ways, Arsenal’s self-sustaining approach has been admirable, though it has often felt like the club has been overly cautious. Gazidis speaks of avoiding “the many examples of clubs across Europe struggling for their very survival after chasing the dream and spending beyond their means”, but Arsenal are a long way from such an awful predicament. As we have seen, Arsenal do face issues around lack of revenue growth and an ever increasing wage bill, but they still have much more room to manoeuvre than most.

"Vermaelen - Tommy, can you hear me?"

The price of Arsenal’s self-sustaining model has been to regularly sell the club’s best players, while charging the highest ticket prices in the country, so this is not quite the financial Utopia that has often been portrayed in the media. For the fans, it must be particularly galling that the club’s two majority shareholders, Stan Kroenke and Alisher Usmanov, are both billionaires, but there is little sign of either making any investment into the squad.

Arsenal’s financial results are undoubtedly impressive and they have done well to consistently finish in the top four, but whether the current strategy is enough to bridge the gap to the leaders and actually win an important trophy is debatable.

The board wastes no opportunity in telling supporters how ambitious the club is, e.g. last month Peter Hill-Wood argued, “We have a pretty good chance of challenging for the Premiership. I don’t see why we cannot win it this year”, but whether the fans believe that this is credible is another matter, especially when the club does not use all the resources at its disposal.

Tidak ada komentar:

Posting Komentar