The end to the football season could not have come quickly enough for Arsenal fans, as their team once again failed to maintain its challenge for honours, falling away to a disappointing fourth place after being Manchester United’s main challengers for so many months. Those of a more artistic persuasion might well have reflected on the words of TS Eliot, “This is the way the world ends, not with a bang but a whimper”, while baseball aficionados might have opted for Yogi Berra’s classic, “It's déjà vu all over again.”

Arsenal’s form declined so much that they only won once in their last seven Premier League games, though with typical contrariness that was against the champions, and lost three times to the might of Bolton Wanderers, Stoke City and Aston Villa. Six points in seven matches is unlikely to bring the long awaited silverware, in fact, it’s relegation form. Little wonder that Arsenal fans exhorted the club to spend some money during the away trip to Fulham, though their message was delivered with a great deal more earthiness.

It has become abundantly clear that Arsenal need to strengthen the side during this summer’s transfer window, adding some experience and steel to the young talents already there. Manager Arsène Wenger has confirmed that there are “resources available” and that he intends to be “very active” in the transfer market, but it is unclear exactly how much the club could afford to spend.

"Robin Van Persie - there is value in the market"

Fans would be little wiser from reading the newspapers, as they have provided a variety of figures. In the last month alone, the Mail on Sunday warned that Wenger would only have £30 million, but the Sunday Express spoke of a £50 million war chest. Falling neatly in the middle, the Daily Telegraph thought that £40 million sounded about right. The only thing that they had in common was a complete lack of explanation of how they had arrived at their figures. Of course, one of them could well be correct, but that’s almost certainly more by luck than judgment.

To be fair, the club has not exactly helped them with their assessments with Wenger saying that he did not know how much was available either, though he added, “The only thing I can say is that the club is in a healthy financial situation and, if needed, we can make a big transfer.”

Unfortunately, this sounds horribly like the noises coming out of the club last year, when chief executive Ivan Gazidis stated, “We have money available to invest in the transfer market when we can identify the right players to add into the mix that add something to the squad.” Even old school chairman Peter Hill-Wood was at it, “We have got more money than we’ve had for a long, long time and we would like to spend it. But we want to spend it sensibly. There is plenty of cash, although not in comparison to Manchester City.”

"Cesc Fabregas - will he stay or will he go?"

However, all this bravado didn’t add up to a tin of beans with the only arrivals being the inexperienced Laurent Koscielny, the disastrous Sebastien Squillaci and Marouane Chamakh (on a free transfer).

Clearly, Arsenal would be foolish to show their hand to other clubs by divulging the size of their transfer budget, but it might be instructive to some fans if we try to make a reasoned estimate of what they could spend, if only to manage expectations.

The first thing to say is that the club actually does have a formal war chest in the shape of the ring-fenced Transfer Proceeds Account (TPA). As a condition of the Emirates Stadium financing deal, the 2006 bond prospectus clearly states that 70% of net sale proceeds must be deposited into the TPA and only used for certain specified reasons including players. The idea is that this protects lenders by ensuring that the club continues to invest in its core asset, i.e. the playing squad, either by buying new players or extending existing contracts.

"Another bargain basement buy"

However, what most people do not appreciate is that this account can also be used for other purposes, such as purchasing other football assets or prepayment of debt, so it’s not absolutely guaranteed that these funds will be used on players. Therefore, it’s not a straightforward exercise to work out how much money remains in the TPA.

Many point to the money received from the £40 million sales of Emmanuel Adebayor and Kolo Toure to Manchester City in 2009, suggesting that this means that at least £28 million should be in the account, but there have been reasonably pricy purchases since then (Vermaelen £10 million, Koscielny £10 million and Squillaci £4 million) and, as we have seen, money could also have been legitimately spent on developing the stadium or academy. In other words, the TPA is no more than a useful indicator of the money available, though the highly respected Arsenal Supporters’ Trust (AST) have estimated a figure of £27 million here.

Perhaps the best starting point for an analysis of Arsenal’s transfer fund is the actual cash balance, which was £110 million in the last published accounts (as at 30 November 2010). The club is keen to emphasise the seasonal nature of cash flows, e.g. money taken from season ticket renewals at the beginning of summer will be used to pay expenses over the next few months, with Gazidis stating, “We are not sitting on a cash balance of over £100 million. We need operating money over the course of the year.”

That’s absolutely correct, but if we look at Arsenal’s cash balances over the last few years, it is clear that the trend has been upwards, rising from £53 million in November 2006 to £110 million in November 2010. Furthermore, the cash balance every May has been around £25 million higher than the previous November, so the current figure should be even higher than the most recent accounts.

In other words, Arsenal’s executive hierarchy might be accused of being a little conservative here, though they do have to maintain £23 million as debt service reserves for the stadium financing, which would mean a net balance of £87 million.

In fact, Arsenal’s ability to generate free cash flow has been very impressive, considering that: (1) most of the cash for the commercial deals with Nike and Emirates was paid upfront; (2) they have also managed to repay all the property debt incurred for the Highbury Square property development (just under £140 million).

Given all these factors, it is virtually impossible to work out how much cash is available without making a few assumptions, so that’s exactly what we are going to do. First, let’s assume that the club requires £42 million for expenses in the second half of the financial year (net of receipts), which is based on the £35 million estimate made a year ago by the good folk at the AST, who are closer to Arsenal’s accounts than anyone else, which I have increased by a prudent 20% primarily to reflect the cost of higher wages. That would leave us with net cash of £45 million.

"Jack Wilshere - a great argument for the youth policy"

We should also deduct transfer fees still owed to other clubs, which are listed in the accounts as £13 million, though Arsenal are also owed £1 million. Given that these other creditors cover both the amounts owed within a year and beyond, it’s safe to estimate a net payable of £10 million in the next 12 months. The club also has contingent liabilities of £14 million, where payments are made based on certain conditions being met, such as number of appearances for the first team or a player’s country, but these are considered less likely, so I have excluded them from our calculation.

So, deducting the £10 million for transfer fees still owed would reduce the net cash to £35 million. Maybe the gentlemen of the press do know something after all, as that is not too far away from the estimates I discovered earlier.

However, Arsenal still have an ace up the sleeve, which is the money they can expect to receive from property sales. Chairman Peter Hill-Wood has confirmed that the property business is now debt-free, so all future sales proceeds (less costs to complete) will boost the cash position. The club has not provided an estimate of how much this will be worth beyond stating, “The next few years will see the accumulation of a fairly significant cash windfall for the Group”, which is accounting speak for a lot of money.

"Arshavin - back to Russia with Love?"

There are two elements to this: (1) the remaining 35 apartments at Highbury Square (620 of 655 have already been sold); (2) other developments acquired as part of the stadium move, including the market housing at Queensland Road (with planning permission for 375 apartments), Hornsey Road and Holloway Road.

Again, we cannot be certain how much these are worth, but we can take an educated guess. Based on the price achieved in the first half of 2010 for Highbury Square (£22.5 million for 50 apartments), we would calculate £15.8 million. Using a similar calculation for 2009 (£96.6 million for 261 apartments), the sum received would be £13 million. An average of the two would imply around £14 million.

It’s even more difficult to place a value on the other developments, but I note that the social housing element of Queensland Road brought in £23 million last year.

In total, the accounts include development property at a cost of £28.2 million, but formally state that the directors consider the net realisable value to be “greater than their book value.” Using a 50% uplift, based on previous transactions, would suggest a value of £42 million, which is very close to the £45 million estimate made by the AST a year ago.

If we assume that the remaining Highbury Square apartments are sold reasonably quickly, we could add £14 million to the £35 million transfer fund we calculated earlier, giving a total of £49 million. Let’s be generous and call it £50 million. OK, there are a few assumptions behind this figure, but these are based on a degree of logic.

That does not include any money from the other property developments, which should be worth around another £30 million (£45 million total less £15 million assumed for Highbury Square). Although that is unlikely to be available for a while, it should under-pin any money laid out this summer.

Given this safety blanket, it is reasonable to ask why Arsenal are still so cautious in the transfer market. After all, everyone knows that they make huge profits, right? Last year, Arsenal reported a record profit before tax of £56 million, but this was no flash in the pan, as they also averaged £41 million in the previous two seasons.

Truly impressive, especially if you consider that only three other Premier League clubs made profits in 2009/10 and all of those were significantly lower than Arsenal: Wolverhampton Wanderers £9 million, WBA £0.5 million and Birmingham £0.1 million. However, while a strong balance sheet is laudable, that cannot be the club’s primary objective, as Hill-Wood admitted, “Our business goal is not to generate profits as such, but rather to grow the club’s revenues, so that they can be re-invested in the team and the long-term success of the club.”

Furthermore, if you look under the bonnet, there are some underlying issues that suggest that the financial picture is not quite so wonderful as it has been painted. In fact, if you exclude the £11 million property profit and the £38 million made from player sales, then the remaining football profit in 2009/10 would only be £7 million. That’s still very respectable, especially as it is net of £14 million interest payments, but the interims really bring the ongoing challenges to the fore.

For the first six months of 2010/11, the club actually made a loss of £6 million, largely because property profits fell to £3 million, while the profit on player sales sharply declined to £4 million, mainly from the sale of Eduardo to Shakhtar Donetsk. In fact, the pure football business produced a loss of £13 million.

To be fair, part of that is due to timing differences with two less home games than the previous season and TV merit payments, but it does suggest that the business model is not quite as robust as previously thought. There has been an undue reliance on player sales with an average £25 million a year being generated from this activity since 2006. Good business, but it makes it hard to build a winning team.

Like every other football club, Arsenal have also had to contend with explosive growth in the wage bill, which has risen from £83 million to £111 million in just four years. This “increased investment in football wages” has further increased the payroll by £4.5 million in the first six months of 2010/11, reflecting a deliberate policy of renegotiating contracts. As Wenger’s budget covers both transfers and wages, just because money is available to him does not necessarily mean that he will use it to purchase new players. Indeed, there is already talk of extending the contracts of Samir Nasri, Gael Clichy and Johan Djourou this summer.

Arsenal’s wage bill of £111 million is still substantially less than Chelsea (£173 million), Manchester City (£133 million) and Manchester United (£132 million), but it is also a lot higher than the chasing pack. In particular, it is a hefty £44 million more than Tottenham (£67 million), who finished just one place lower in the Premier League.

This sometimes comes as a surprise to many fans, given Arsenal’s well-publicised sustainable model, but is due to a couple of factors. They have a large squad and, while the wages at the top end might not be the highest, the fringe players like Denilson and Rosicky are handsomely awarded, as are the young players.

This is a policy that is worth reviewing, as a degree of complacency would appear to have set in at this level and some judicious pruning of the dead wood could free up wages for a couple of genuine world class talents. In addition, it would be worth introducing a higher element of performance-related pay to concentrate the collective mind on striving to win trophies.

Clearly, wages are a massively significant factor when it comes to signing new players, even though that great sage Jamie Redknapp has ludicrously asserted that “you can’t get cheaper than a free transfer.” For example, Marouane Chamakh cost the Gunners nothing when he arrived from Bordeaux, but a five-year deal on a reported £50,000 a week represents a £12.5 million commitment. That said, any increase in the wage bill from incoming players could be largely met by the reductions from departing players, so this argument cuts both ways.

There would also appear to be scope for some cost cutting elsewhere, as the annual costs of £55m for “other operating charges”, i.e. excluding salaries and amortisation, are on the high side. Unfortunately, the club does not provide much detail for these costs, but they must include items like stadium operating costs, travel and training. On its own, the absolute figure is fairly meaningless, but it accounts for 27% of Arsenal’s total costs, which is a higher proportion than any of the other leading Premier League clubs with the others ranging from 18-23%.

One area that has really restricted Arsenal’s ability to operate at the higher end of the transfer market is their woeful commercial income of £44 million, which lags way behind the rest of Europe’s elite. According to Deloitte’s Money League, Bayern Munich £142 million and Real Madrid £123 million generate three times as much revenue from such activity, while Manchester United have announced that they will break the £100 million barrier this year.

Arsenal’s weakness arises from the fact they had to tie themselves into long-term deals to provide security for the stadium financing, which arguably made sense at the time, but recent deals by other clubs have highlighted the lost opportunities. The Emirates deal was worth £90 million, covering 15 years of stadium naming rights (£42 million) running until 2020/21 and 8 years of shirt sponsorship (£48 million) until 2013/14. Similarly, the club signed a 7-year kit supplier deal with Nike for £55 million until 2011/12, but that has since been extended by 3 years until 2013/14.

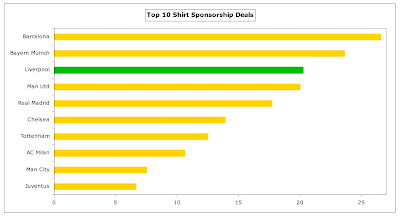

So, following step-ups, the shirt sponsorship deal is reportedly worth £5.5 million a season, which compares highly unfavourably to the £20 million earned by Liverpool from Standard Chartered and Manchester United from Aon. It’s the same story with the kit deal, which now delivers £8 million a season, compared to the £25 million deal recently announced by Liverpool with Warrior Sports and the £25.4 million paid to Manchester United by Nike (yes, the same company that pays Arsenal much less).

It’s not overly dramatic to say that Arsenal leave over £30 million a season on the table, because of their poor commercial deals, which is the equivalent of one great player a season.

Arsenal’s new owner Stan Kroenke has said that he “intends to use his experience to help Arsenal continue to grow its global brand”, including persuading Wenger to take his side on a pre-season tour to Asia, but he might also consider whether it would be worth buying out these punitive commercial contracts, as Chelsea did a few years ago.

Arsenal have restructured their commercial team at great expense, recruiting Tom Fox from the NBA in August 2009, but to be perfectly candid they have not delivered much to date. In fact, commercial revenue actually fell £4 million in 2009/10. They might argue that their hands are tied with the long-term deals, but if that is the case, what was the point in hiring such costly executives? In any case, they should be able to work freely on secondary sponsor deals, which has been an important source of United’s impressive growth. When the interim results were announced, Gazidis said that fans would “begin to see some results over the next year” – let’s hope so.

Another factor that could impinge on Arsenal’s spending plans is the imminent arrival of UEFA’s Financial Fair Play regulations, which aim to force clubs to live within their means. Over the next two seasons, a club will only be allowed to make an aggregate loss of €45 million, but that assumes that the owner covers the loss, which has not been the modus operandi at Arsenal to date. Otherwise, the acceptable deviation is only €5 million.

In other words, if Arsenal opted to accept a few losses while they spent big on transfers, FFP might present them with some problems, even though they would be able to exclude costs incurred for the academy and stadium construction. Given the manager’s frequent criticisms of financial doping, such a move must be considered highly unlikely, but we are exploring all possibilities here.

Even Wenger mentioned that his policy might be about to change: “The market will be hyperactive because everyone believes financial fair play will happen soon. So we are quickly doing the last buying before the stores will be closed. And for the first time for a while, I will be very active too.” Although this is encouraging news to many fans, it is a little worrying to us financial types, as it implies that Wenger does not full appreciate that the resulting amortisation from buying new players will be included in UEFA’s break-even calculation – somewhat surprising, as he has a master’s degree in economics.

More positively, what could Arsenal do to enhance their spending power?

The most obvious tactic would be to sell some under-performing players and add that money to the transfer fund. Arsenal are well-versed in this art, being the only leading club to make money from buying and selling players in the era of foreign ownership (starting from the arrival of Roman Abramovich at Chelsea). Since 2003/04, Arsenal have net proceeds of £3 million, while Chelsea and Manchester City have spent almost £400 million. The “Redknapp factor” has helped Spurs spend £132 million in the same period, though his predecessors were no slouches in this department.

Most Arsenal fans would agree that there’s no shortage of candidates that could depart with minimal impact, though the most likely to go are Denilson and Nicklas Bendtner, who have both openly spoken of their desire to leave and could raise around £16 million. Others might also be given a nudge, like the inconsistent Diaby, the erratic Eboue, the dreadful Manuel Almunia and Tomas Rosicky, whose best days are sadly behind him.

One potential difficulty would be finding clubs willing to match their exorbitant salaries, but there are ways and means. Of course, these players would have to be replaced, though I reckon this could be done more cost effectively, especially if cheaper, hungrier youngsters like Henri Lansbury, Francis Coquelin and Benik Afobe return from their loan spells. That would also ensure that the club did not fall foul of the Premier League homegrown player rule.

"When will Silent Stan become Stan the Man?"

This would represent a fairly radical change in policy from Wenger, who has been quoted in the past as not wanting to introduce too many new players at the same time, but the performances in the last few weeks of the season were so dispiriting that he might just throw caution to the wind. That might also include the sale of one or more of the team’s stars, like Cesc Fabregas, Andrei Arshavin or Samir Nasri, which would release substantial funds for a major rebuild. Personally, I wouldn’t bet on this, but nor would I be hugely surprised if it did come to pass.

There is another aspect of how transfers work that is not always fully appreciated, namely many fees are not paid upfront, but in stages. In this way, a club might only have to lay out, say, £8 million immediately for a £24 million player with the other two slices being paid over the next two years. This is fairly standard practice on the continent, which was why Barcelona owed Arsenal so much money for so long for Henry and Hleb (though they don’t any more). That’s one way of “increasing” a club’s transfer fund, but this method should be used with discretion, otherwise you might just be storing up problems for the future.

On a similar theme, Arsenal could also take on more debt, as the balance sheet is very strong. Some supporters erroneously believe that the club is now debt-free, as they have paid off all the property development debt, but it is true that they have managed to reduce their gross debt to £263 million, which effectively represents the long-term “mortgage” on the Emirates stadium. Given that the gross debt has been reduced from the £411 million peak in 2008, there is clearly some room to manoeuvre here.

On the other hand, this would be a great opportunity for Stan Kroenke to make an immediate impact at the club by paying off this debt early in order to reduce the cost of servicing these loans (around £19 million a year including £5 million of capital repayment). The money saved could then be used to improve the squad. Frankly, given Kroenke’s praise for Arsenal’s self-sustaining model, this does not seem too likely, but other club owners have been known to go down this path.

Even though Kroenke is one of the wealthiest men on the planet, he gives every sign of being a careful investor, waiting for Arsenal to flourish under UEFA’s Financial Fair Play restrictions. His motto for the time being appears to be no major change, which would militate against the club embarking on a spending spree this summer. That said, he would like to be associated with a winning club, so there might be some encouragement for the manager to act more decisively when pursuing a new player.

In any case, we do know that Arsenal will benefit from some revenue growth , as they expect to generate £4.5 million from the deeply unpopular 6.5% increase in ticket prices for next season. Although part of this is down to the 2.5% VAT rise, the remaining inflationary increase is a bitter pill to swallow for fans that already pay the highest prices in world football.

In the business world, price increases are often considered the path of least resistance, and football club owners are proving increasingly happy to adopt the same approach, as their “customers” have the fiercest brand loyalty around. After all, an Arsenal fan is hardly likely to switch his allegiance to Spurs.

Arsenal’s fifth place in Deloitte’s Money League owes a great deal to their £94 million match day income, which is only surpassed by Real Madrid and Manchester United. In fact, 42% of Arsenal’s total revenue comes from match day, far higher than any other club, emphasising how reliant they are on their fans (including the “prawn sandwich brigade”), though it also serves to underline how feeble the commercial income is. Among the top 20 clubs in the Money League, only Aston Villa earn a lower proportion of their revenue from commercial activities.

In addition, the Premier League’s new TV deal, running from 2010 to 2013, is much higher than the previous contract following the significant increase in overseas rights. Hence, Arsenal’s distribution in 2010/11 has increased by £4.5 million to £56.3 million, even though they finished one place lower in the Premier League.

However, that also reinforces the importance of a team succeeding on the pitch from the financial perspective.

Not only has Arsenal’s deterioration in April and May devastated the club’s fans, but it has also hurt their bank balance. The immediate impact of dropping from second to fourth place means that their Premier League merit payment is £1.5 million lower, but the damage does not stop there, as it also has an effect on money from next season’s Champions League.

"No need to buy a new keeper after Szczesny's emergence"

The revenue distribution from UEFA comprises participation fees, prize money plus an allocation of the market (TV) pool, which is split 50% between progress in the Champions League and 50% based on the club’s finish in the previous season’s Premier League.

For England, assuming that four clubs reach the group stages, the latter element is divided as follows: 40% to club finishing first in Premier League, 30% for second, 20% for third and 10% for fourth. This year, that process resulted in the club finishing second in 2008/09 (Manchester United) receiving £10.6 million, while the club that finished fourth (Spurs) got £3.5 million – a difference of £7.1 million. This will be mitigated to some extent by the gate receipts from Arsenal’s qualifying match, but that brings other potential problems.

Speaking of the Champions League, Arsenal’s failure to win the group last season, due to pitiful defeats against Shakhtar Donetsk and Braga also cost them dear. First, each win in the group stage is worth €800,000, while a draw brings a club €400,000. Then, if Arsenal had won the group and avoided Barcelona, they might well have reached the quarter-finals, which would have been worth another €3.3 million prize money and €1.3 million from the market pool progress allocation. Let’s assume Arsenal had pulled their collective finger out, drawn the last two group games and reached the quarter-final. That would have been worth an additional €5.4 million (or £4.6 million).

This is all very theoretical, but the point remains valid: a little more effort on the pitch would have brought higher financial rewards, which might just have avoided the need to raise ticket prices. Go figure, Arsenal fans.

Of course, the doomsday scenario is that Arsenal don’t actually qualify for the Champions League group stages. They will be seeded, but could still draw an awkward opponent at an inconvenient stage of their preparation, so it’s far from guaranteed that they will get through – yet another drawback of finishing fourth. If they don’t make it, they will lose out on at least £25 million, not including additional gate receipts.

Arsenal’s bond prospectus confirmed that more revenue could be generated from commercial deals if the team does the business on the pitch: “AFC can earn additional bonus payments depending on the performance of the first team.” Apart from such uplifts in existing deals, it is evident that sponsors like to be associated with winners, so this should also be a consideration when it comes to deciding how much to spend on buying new players. That ignores the increase in shirt sales and other merchandising that normally results from a club having a world-class player or two on its books.

Given the revenue shortfalls from a relative lack of success, another way of looking at Arsenal’s transfer policy is to ask whether the club can afford not to spend, especially as others seem happy to buy their way to success. The traditional “Sky Four” has been gate-crashed by the extremely wealthy Manchester City and the big-spending Tottenham, so Arsenal can no longer take for granted that they will secure the lucrative Champions League qualification every season. Besides, on the form of the last few weeks, I’m not sure that Arsenal could approach any match with a great deal of confidence.

"Nik Bendtner - must be worth £10m of someone's money"

However, there is no doubt that this Arsenal team does have potential, as evidenced by rousing victories over Barcelona, Chelsea and Manchester United, so it’s not entirely unreasonable when Wenger said that it would be “completely stupid” to make significant changes to the squad this summer. He has argued that he does not want to “kill” his young players’ development, “If I go out and buy players, then Jack Wilshere does not come through”, which may be true, but there are other players in the Arsenal team that do not possess the same ability, nor demonstrate the young Englishman’s desire on the pitch.

There do seem to be some mixed messages coming out of North London these days. On the one hand, Wenger attributes his unwillingness to spend to a profoundly held belief in his policy, “You cannot come to a conclusion that this team needs a massive change. We are there, but because we have not won trophies, people destroy us completely.” However, this sounds terribly similar to his words last summer, when he argued, “I feel we have made huge steps forward this year compared to last year.”

On the other hand, he sometimes implies that his hands are tied financially, “Even if people say you have to spend money, we have to be realistic. We can’t buy players for £50 million. That is a fact.” However, there are several arguments against this perspective: (a) few sensible supporters want Arsenal to spend that much on one player; (b) very good players can be bought for much smaller sums, e.g. Mesut Ozil, Nuri Sahin and Rafael Van der Vaart; (c) as we have seen, money is available to improve the squad, probably around £50 million.

"Thomas Vermaelen - like a new signing"

Indeed, Wenger himself seemed to suggest that was the case, saying that the club has the resources to secure the services of a top talent. While his priority might be to keep his star players, he has also admitted that he wants to strengthen, though this does not necessarily imply lots of comings and goings, “It’s not the number, it’s the quality.” That might not be such a bad outcome for Arsenal fans. If the club does manage to buy 3-4 proven, world class players with the requisite winning mentality, that could make an enormous difference to such a young team.

For many years Wenger was effectively fighting with one arm tied behind his back, due to the financial constraints imposed by building the new stadium, but the club now has sufficient funds available to spend again, albeit not at stratospheric levels, without compromising its sustainable model. They need to do something, because one thing is certain: if you keep doing the same thing, you’ll keep getting the same results.