Sabtu, 08 November 2014

Pronostici Bundesliga 9 novembre 2014

PRONOSTICI BUNDESLIGA: 9 novembre 2014 (11° giornata)

LEGGI TUTTO L'ARTICOLO»

Jumat, 31 Oktober 2014

Probabili formazioni e pronostico Bayern Monaco-Borussia Dortmund 1° novembre 2014

PROBABILI FORMAZIONI BAYERN - DORTMUND: 1° novembre 2014

LEGGI TUTTO L'ARTICOLO»

Kamis, 30 Oktober 2014

Pronostico Bayern Monaco-Borussia Dortmund 1° novembre 2014

PRONOSTICO BAYERN - DORTMUND: 1° novembre 2014

LEGGI TUTTO L'ARTICOLO»

Senin, 29 Oktober 2012

Borussia Dortmund - Back In The Game

Kamis, 28 Oktober 2010

Borussia Dortmund's Road To Recovery

Amid all the excitement about Mainz’s exhilarating start to the new German season, Borussia Dortmund’s surge into second place in the Bundesliga, winning seven of their first nine matches, including the impressive disposal of fierce local rivals Schalke 04 in the Revierderby, has gone largely unnoticed, even though Jürgen Klopp’s young, athletic team puts on show a similar brand of aggressive, attacking football.

These impressive displays provide the most tangible evidence yet that Borussia have largely recovered from their financial difficulties of 2005 when they flirted with bankruptcy. Since then, the club has been languishing in the football doldrums, but has made considerable progress in the last three seasons. From the mid-table obscurity of 13th position in 2008, they improved to 6th place in 2009 and managed to qualify for the UEFA Europa League last season by finishing in a very creditable 5th.

Although the club’s 2009 annual report boasted, “BVB is back”, it is still too early to say whether Borussia Dortmund have enough strength in depth to maintain their challenge for the Bundesliga. What we can declare with more confidence is that this team still has a long way to go to emulate the glory days of their legendary counterparts from the golden era of the mid-90s.

"Glory Days"

During this magical period, Ottmar Hitzfeld’s team won successive Bundesliga titles in 1995 and 1996, with combative midfielder Matthias Sammer being named European Footballer of the Year, before triumphing in the 1997 UEFA Champions League, when two goals from Karl-Heinz Riedle and one from local hero Lars Ricken sealed a 3-1 win against a Juventus side that included Zinedine Zidane and Alessandro Del Piero.

In fact, Borussia Dortmund is a club steeped in history, celebrating its centenary last year with a friendly match against Real Madrid. It is one of the most successful, well known and popular German football clubs, having won the Bundesliga six times, the German (DFB) Cup twice and the European Cup Winners’ Cup in 1966 – when they were the first German team to secure a European title, beating Liverpool 2-1 in the final.

However, more recently, Borussia’s sights have been set somewhat lower with the club happy to merely qualify for the UEFA Cup in 2008 by the back door, after losing the DFB Final to a Bayern Munich side that had already secured a Champions League spot by winning the German championship. In fairness, this did mark a step forward, given that it was the first time the club had qualified for Europe since 2004. Furthermore, the previous season had seen the club involved in a relegation battle, that provoked two changes in management, when Bert van Marwijk was replaced in the winter break by Jürgen Röber, before a run of six defeats in seven matches resulted in yet another new coach in the shape of former German national, Thomas Doll.

"Nuri Sahin - Turkish delight"

Terrible times, but since Jürgen Klopp arrived in May 2008, the team has gone from strength to strength, keeping the incoming coach’s promise of showing supporters “full-throttle football with passion.” The club’s philosophy entails building up a very fit team of young, ambitious and talented players, backed up by experienced “pillars”, which allows them to apply an energetic, pressing game that is much appreciated by their huge crowd. The jewel in the crown is the 22-year old Turkish playmaker Nuri Sahin, who first played in the Bundesliga at just 16, but Borussia’s youngsters have also been recognised by the German national team with attacking midfielder Kevin Großkreutz and central defender Mats Hummels making their debuts this year.

The club’s focus on youth looks likely to benefit the Nationalmannschaft for years to come, following the emergence of other young stars such as Mario Götze (18 years), Sven Bender (21) and Marcel Schmelzer (22), but Borussia’s roster also includes a very impressive collection from a variety of other nations, including the imposing Serb defender Neven Subotic (21), the exciting Japanese midfielder Shinji Kagawa (21) and the Polish internationals, Robert Lewandowski (22) and Jakub “Kuba” Blaszczykowski (24).

The experienced backbone is provided by captain Sebastian Kehl, goalkeeper Roman Weidenfeller and defender Patrick Owomoyela, who have over 600 appearances in Germany’s top division between them.

"Shinji Kagawa - turning Japanese"

To some extent, Borussia have had to make a virtue out of necessity following the constraints imposed by their economic meltdown a few years ago. The club’s difficulties first became apparent in 2002, when poor financial management resulted in an unmanageable debt load that meant the club had to sell its famous Westfalenstadion to a real estate trust. All the funds raised from their flotation on the German stock exchange two years before (the first and to date only listing of a German football club) had effectively been squandered.

Worse was to come in 2005 after the club spent heavily on expensive signings and high wages in the pursuit of further European glory. In a scenario horribly reminiscent of Leeds United’s misguided strategy, Borussia effectively gambled on competing regularly in the Champions League to fund their spending. Although they managed to avoid relegation, the club’s record losses and massive debts put them in a “life-threatening situation.”

The approach of trying to buy success was far too ambitious for a club of Borussia’s relatively limited means and its spectacular failure meant that the old regime, which had been in charge for nearly 20 years, had to be replaced. The new chairman, Hans-Joachim Watzke, summed up the reasons for their downfall, “We have problems, because our success was not as we hoped. Perhaps we spent money that we don’t have. We thought that we could be in the Champions League for many years.” The line between success and failure in the world of football is indeed a thin one.

"Neven Subotic - in demand"

However, football clubs can always count on the “never say die” spirit of their supporters and in their moment of need the BVB fans did not let their club down. Their “We are Borussia” campaign resulted in Dortmund’s community of citizens, companies and public authorities combining to help save the club, so much so that in 2008, the club’s annual report could proudly announce, “Three and a half years after facing the very real threat of insolvency, Borussia Dortmund has regained a solid economic foothold and is so sound that we no longer need to worry about financial problems, not to mention problems that would threaten our continued existence.”

Having said that, it is doubtful whether the club could have carried on in 2005 without some very understanding creditors and bank managers, who deferred stadium rent and interest payments until 2007. The club also had to take out yet another loan to help pay the players’ salaries, while they were forced to shore up the balance sheet in 2006 with significant capital increases that reduced liabilities and improved the equity position from €15 million to €61 million. The funds raised enabled the club to achieve a more manageable debt maturity structure and obtain improved interest rate terms.

At least they avoided the potential ignominy of accepting help from their rivals Bayern Munich in order to bolster its ailing finances, which looked like a distinct possibility at one stage. The club also rejected a sponsorship offer from Beate Uhse, a chain of sex shops. It’s not clear which would have been the bitterer pill to swallow for BVB fans.

"The most beautiful stadium in the world?"

Instead, in 2006 the club took out a 15-year loan of €79 million with Morgan Stanley, thereby laying the foundations for the long-term stabilisation of the company. They used €57 million to buy back the remaining 51% of the shares in their stadium from the Molsiris real estate investment fund, thus reducing the high rental expenses and giving them more room to manoeuvre. The remaining €22 million was used to reduce and refinance existing liabilities, which enabled the creditors’ agreement of March 2005 to be annulled in June 2006.

The restructuring process was completed two years later, when €50 million of cash received after signing a new 12-year marketing agreement with Sportfive was used to fully repay the Morgan Stanley loan many years ahead of schedule. The club promised that this move would not only further reduce its liabilities, but would free up funds to improve its sporting competitiveness over the next few years. The advancement in league position in the last couple of seasons would indicate that the club has been true to its word.

That improvement has also been reflected in the club’s financials. Following the club’s annus horribilis in 2005 with an enormous €55 million loss, the club instigated some drastic cost cutting, slashing the wage bill by €10 million and reducing player amortisation by €13 million over the next two years. Allied with an increase in the Bundesliga TV deal, the sale of David Odonkor to Betis and money distributed after the 2006 World Cup (held in Germany), this produced a remarkable €15 million profit in 2007.

In each of the last two years, Borussia Dortmund have reported a loss of about €6 million, though they have just about broken even at the operating level (before interest payments). That’s not too bad in the current economic climate with the club “unable to completely sidestep the fallout from this crisis”, especially in the absence of major European competition to boost revenues.

This year’s results were also impacted by lower profits from player sales and would actually have shown an improvement on the prior year if Nelson Valdez’s €4 million summer transfer to newly promoted La Liga side Hercules had taken place a few week earlier. Like all other clubs, Borussia’s results were affected by the World Cup in South Africa, which pushed back most transfer activity to beyond the closing of their accounts at end-June. Having said that, over the years, player trading has not contributed a great deal to Borussia’s profits (never higher than €5 million), even when their finances forced them to offload a number of players.

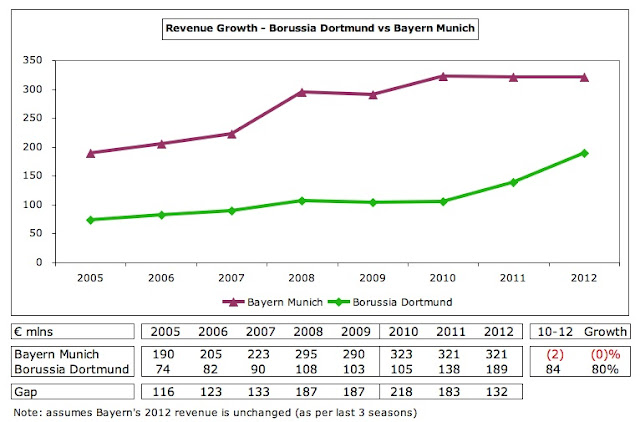

Even though Borussia Dortmund achieved their highest position in the Deloittes Money League in 2009 since 2003, the reality is that their revenue is a long way short of most major European clubs. Their 18th place with revenue of €103 million is the lowest of the five German teams in the Money League, behind Bayern Munich €290 million, Hamburger SV €147 million, Schalke 04 €124 million and Werder Bremen €115 million. In fact, Bayern’s revenue is almost three times that of Borussia, while Real Madrid and Barcelona generate almost four times as much as them.

What is immediately apparent is the very low income from match day and television (with no Champions League boost), though the commercial revenue is surprisingly high – more than teams like Arsenal, Lyon, Juventus and Inter. In fact, commercial revenue contributes the highest percentage of total revenue of any of the teams in the Money League at 57% with only fellow German clubs Bayern (55%) and Schalke (49%) coming anywhere near that astonishing figure.

Revenue has risen 42% since the dark days of 2005, largely through the advances on the commercial side, which is a big reason for the improvement in the bottom line. However, since breaking through the €100 million barrier for the first time in 2008, there has hardly been any increase, which might suggest that there is a limit to the scope for future revenue growth – unless they qualify for the promised land of the Champions League or take the unpopular step of raising ticket prices.

Total income has actually fallen by £9 million since 2008, mainly due to the €7 million decline in other operating income, which was inflated that year by a couple of once-off factors, namely compensation paid to clubs that released international players for the 2008 European Championships and the sale of the swap transaction with Deutsche Bank as part of the repayment of the credit facility with Morgan Stanley.

At this stage, I should make clear that I am using the Deloittes definition of revenue in order to facilitate comparisons with other European clubs, so have excluded transfer income (€11.2 million in 2008/09). Adding that to the Money League revenue of €103.5 million gives the €114.7 million revenue reported by Borussia Dortmund. You should also note that the costs (accumulated depreciation) associated with transfers have been deducted from other expenses to give the profit on player sales, e.g. in 2008/09 transfer income of €11.2 million less transfer expenses of €7.2 million produced a profit on player sales of €4.0 million.

Some will be a little perplexed about the paradox of Borussia Dortmund enjoying some of the largest crowds in Europe, yet having one of the lowest match day revenues in the Money League with only Roma and Juventus generating less than Borussia’s €22 million in 2009, but the reason is an obvious one: very low ticket prices. This is the antithesis of the English approach, which sees Manchester United and Arsenal earn five to six times as much from this revenue stream, but Bayern’s €61 million is also nearly three times as much as their German colleagues.

Last season, Borussia Dortmund’s incredible average attendance of 76,400 was the second highest in Europe, only beaten by Barcelona 78,100, but above Manchester United 74,800. This was easily the largest average in Germany with the next highest teams being Bayern 69,500 and Schalke 61,200. The Borussia fans’ interest shows no sign of slowing down, as the club has just established a new record for season tickets for 2010/11 at a mighty 51,200, beating last season’s previous high of 50,700.

Borussia’s high attendances (and low match day revenue) can be partially attributed to the large number of standing places (around 27,000) for which tickets are priced as low as €12. Around 25,000 of these can be found on the famous Südtribüne terrace, known as the “Yellow Wall”, which is the largest standing area in European football and provides each home game with an intensely passionate atmosphere.

It is surely no coincidence that the Bundesliga has the lowest ticket prices of Europe’s five major leagues and consequently the highest attendances. The Bundesliga chief executive, Christian Seifert, argues that keeping tickets cheap is part of German clubs’ core value of placing the supporter first, as they know how valuable the fan base is. According to Deloittes, the average price for a Bundesliga match is €19 compared to €51 in the Premier League, which is almost three times as much. That’s a huge difference, especially for younger supporters.

"Sebastian Kehl - the leader of the pack"

This is an important part of football culture for German fans, who would be extremely resistant to higher ticket prices. Recently, Borussia fans voted with their feet when they boycotted the derby at Schalke, after their rivals demanded a 50% surcharge for this match. The chairman of one of the BVB supporters groups, Marc Quambusch, argued that this was the thin end of the wedge, “If we simply accept higher prices, we’ll end up like the Premier League, where young people are priced out and the crowd is getting older and older.” Jürgen Klopp injected some humour into the situation, when he said, “I think it’s great our people don’t go there to finance (new striker) Klaas-Jan Huntelaar.”

For the moment, there are no such problems in Borussia’s imposing stadium, now officially named Signal Iduna Park, which is the largest football ground in Germany with a capacity of 80,700. This is obviously an extremely valuable asset that can also be used to host international matches, when the capacity is reduced to 67,000 by converting the standing areas to seats (which only takes two days). The Times described it as the “most beautiful stadium in the world”, writing, “Every Champions League final should be held in Dortmund. The place was built for football and its fans.”

When you look at Borussia’s paltry TV revenue of €22 million in 2009, which is by far the lowest in the Money League, it gives you some idea of the financial challenges they still face. Clearly, this would be much higher if they reached the Champions League (Wolfsburg, for example, received €26 million last season), but in the meantime their broadcasting revenue is almost entirely sourced from the DFL (German Football League).

The current deal runs for four years from 2009 to 2013 and is worth €1.65 billion for domestic rights, which works out as €412 million per season. This is slightly higher than the previous three-year contract, which was worth just over €400 million a year, though that did represent a 40% increase on the preceding agreement. The Bundesliga deal is about 40% lower than the €700 million received per season by the Premier League for domestic rights, which is bad enough, but is nothing compared to the disparity on overseas rights, where the Bundesliga only receives €40 million against €550 million for the Premier League. For all its many attractions, it is clear that the Bundesliga has not successfully marketed itself globally. As a result, German clubs receive far less TV money than their English peers, e.g. Bayern earned €70 million in 2008/09, which was considerably less than Manchester United’s €117 million.

The DFL TV money is distributed among clubs using a weighted calculation based on the performance over the last four seasons plus a bonus depending on the final position in the current season. However, Borussia’s television revenue has actually decreased over each of the last two seasons from €26 million to €21 million, even though their positions in the Bundesliga has been improving. The €4 million fall in 2009 was due to the team’s elimination in the third round of the DFB Cup, compared to reaching the final the previous season, while the 2010 decline was again due to fewer cup matches.

"Happy days are here again"

As we highlighted earlier, what really drives Borussia Dortmund’s revenue, like so many German clubs, is their commercial operation, which this year topped €60 million for the first time, comprising €39 million sponsorship, €8 million merchandising, €9 million catering and €5 million rentals. It was just as well for this revenue stream that the club bought back its merchandising trademark in 2006, which had been sold in 2000 as part of its efforts to raise money.

The club has implemented a strategy of building trusted long-term relationships with commercial partners, many of whom have recently extended their contracts with the club, including Sportfive, who have signed with the club until 2020, by which time they will have been the club’s marketing partner for 20 years. Similarly, insurance and financial services provider Signal Iduna has extended its stadium naming rights deal, whereby it pays €4 million a year, until 2016.

This approach has also been followed by shirt sponsor Evonik, which prolonged its agreement to 2013, paying over €7 million a year. They had been part of an imaginative campaign whereby Borussia played the 2006/07 season with a green and yellow exclamation mark on their shirts, while the RAG energy company came up with the Evonik brand. German clubs have proved very adept at securing valuable shirt sponsorship deals, so much so that a report by sports consultancy StageUp showed that shirt sponsorship revenue in the Bundesliga is actually higher than the Premier League.

"Lucas Barrios - sharp shooter"

Nike were replaced by Kappa as kit suppliers in 2009/10 in a three-year deal worth €4 million a season, while Sportfive have succeeded in increasing the number of so-called “champion partners”, the list now including Sprehe Feinkost, AWD, Coca Cola, Radeberger and Sparda Bank.

Moving on to expenses, Borussia have clearly made efforts to control their costs. Not only have their operating expenses been virtually unchanged over the last three years at around €110 million, but they are still lower than the €117 million spent in 2005. Having said that, other expenses of €45 million seem fairly high, though this does include €17 million for match operations, €11 million advertising, €6 million administration and €5 million materials (primarily merchandising).

Where Borussia have been particularly effective is in controlling their wage bill, as evidenced by the wages to turnover ratio, which has never been above 48% since the big spending year of 2005. The club has prioritised a reduction in its payroll, so wages were cut €2 million last season to €48 million, giving a very respectable wages to turnover ratio of 46%.

This is not overly surprising, given the Bundesliga’s focus on this ratio, as can be seen by Deloitte’s last review of the major European leagues, which revealed that the average wages to turnover ratio for the Bundesliga was just under 50%, compared to 66% in the Premier League. This is the main reason why the Bundesliga is more profitable (€172 million) than the Premier League (€93 million), even though its revenue (€1.6 billion) is much lower than its English equivalent (€2.4 billion).

Even so, Borussia’s wages of €46 million are less than a third of Bayern’s €139 million, though the champions’ revenue is, of course, also around three times higher. To provide an English comparison, Borussia’s wage bill is about the same as Bolton Wanderers, which should place their European aspirations into context. It must be tough to compete against the likes of Real Madrid and Inter Milan when their wage bill is four times as much as yours.

The trend in player amortisation, namely the annual cost of writing down the cost of buying new players, also reflects Borussia’s fall and rise. It peaked at €18 million in 2005, but was then greatly reduced to €5 million in 2007, as the club reacted to its financial predicament, but it has steadily risen again, albeit to a much lower level at €9 million, as the club has ventured back into the transfer market, now that the worst of its monetary problems seem to be behind it. Again, this is much lower than other clubs with Bayern’s €33 million being a pertinent comparison.

The graph of net transfer spend for the last 12 years beautifully demonstrates this trend and highlights one of the main reason for Borussia getting into debt. In the five years before the fateful 2004/05 season, the club’s net spend was €95 million (gross €128 million), but then they hit the brakes with net surpluses generated over the next three years, followed by very modest net spend in the last four years. Over that seven-year period, Borussia had a net surplus of €5 million – a stark contrast to their extravagant epoch.

The club obviously now has an objective of balancing its books, which effectively means that it has to sell before it can buy. In recent years, this has meant the sale of players like Alex Frei, Mladen Petric, Steven Pienaar and Tomas Rosicky. Even now, after all that the club has done to reinforce its financial stability, it still cannot operate with complete freedom in the transfer market. In order to meet financial targets, the club may not pursue certain players if that would incur additional debt. For the same reason, a player may have to be sold, even if the coach wants to keep him on sporting grounds. That might be the case with the highly rated defender, Neven Subotic, next summer.

Borussia’s sporting director, Michael Zorc, has been criticised for his track record on player purchases, but he must sometimes feel like he is fighting with one hand tied behind his back. Nevertheless, he has still managed to unearth some gems, such as the brilliant Shinji Kagawa, who was signed for only €350,000 from the J-League, and has already won over the fans by scoring twice against bitter rivals Schalke, and top scorer Lucas Barrios, bought for €4 million from Paraguayan side Colo-Colo, whom Zorc described as “a goal machine, the best striker we have had since Stéphane Chapuisat.”

The club also possesses what it describes as “hidden reserves” among the playing staff, following its policy of recruiting young talent with a lot of potential. This means that their value in the transfer market is much higher than that recorded in the books. To further this objective, they have founded the BVB Academy to facilitate the targeted, comprehensive development of players aged between 19 and 23 years old.

Given that the club’s financial problems are still fresh in the memory, it is entirely understandable that Borussia exercise a degree of caution. Even though they have managed to reduce their net debt from €150 million in 2006 to €73 million today, mainly due to the repayment of the Morgan Stanley loan, this is still a high figure by Bundesliga standards. The loans have maturity dates between 2020 and 2026 with a weighted average interest rate of 6.6%, but, importantly, the club is not exposed to any interest rate risk thanks to the fixed interest nature of the credit agreements. However, despite making some loan repayments, the net debt has actually been creeping up over the past two years, as the club has increased its use of overdraft facilities up to €10 million.

Borussia Dortmund’s financial difficulties do beg the question of whether the Bundesliga’s licencing rules are not quite so effective in practice as we have been led to believe. These regulations include looking at a club’s books each March in order to assess the robustness of their budgetary plans before issuing them a licence to operate the next season. In addition, the “50+1” rule, which dictates that club members must own at least 50% plus one share in order to prevent the club being subject to the whims of an individual owner, theoretically means that clubs should not take on potentially damaging debt levels.

Despite these well-intended rules, a number of clubs have still managed to get themselves into deep financial trouble over the years, Borussia being the obvious example, but Schalke’s finances have also caused concern in the past few months. Clearly, no rules can ever be perfect and there will always be exceptional cases, but let’s hope that the Bundesliga has learned some lessons here and tightened up their procedures, including a better early warning system.

"Klopp hands - here comes Jürgen"

In order for Borussia to avoid returning to such a position, or, more positively, for the club to further improve, it will need to grow its revenue, but is this feasible?

Well, there are a few opportunities. The best route would be via success on the pitch, particularly qualification for the Champions League. If the club could achieve that (and keep qualifying year after year), it would be a whole new ball game financially. Fortunately for them, although this is not a walk in the park, it is far from insurmountable and they would have managed it last season if they had won either of their last two matches. The German league is also far more open than others, so it’s not a given that certain teams will always qualify no matter what. As Steve McClaren, Wolfsburg’s new coach enthused, “The beauty of the Bundesliga is any one of ten teams can win the title.”

They could also make more use of their magnificent stadium by staging international matches and marketing it for more events on non-game days. In fact, even though commercial revenue is already high, better use of the BVB brand could further improve merchandising sales, especially as Borussia Dortmund is the fourth most popular club amongst Germany’s football followers (according to market research). Finally, although the fans might not appreciate it, there is a lot of unrealised profit that could be crystallised by selling some of the up and coming young players to richer clubs.

"And it was all yellow"

The current strategy still needs to have an eye on gradually improving the financial structure, an approach that the club has described as “sustainability before speed.” In the period shortly after Borussia Dortmund came so close to extinction, the club revealed its new credo: “sporting success cannot be achieved without exercising good business sense.” Not the most stirring words that you’ll ever hear, but I’m sure that most BVB fans are thankful that the club appears to be in safe hands and they are heading in the right direction.

The rest of us should be equally happy that this grand old club survived and seems well on the road to recovery, if only so that we can continue to enjoy the spectacle of the “Yellow Wall” in full voice, which is one of the truly great sights in modern football. Forget Phil Spector, that’s what I call a wall of sound.

.jpg)

.jpg)